Information on the financial statements for the year ending

31 December 2023

Ernst & Young AG has audited the pension fund’s financial statements for the year ending 31 December.

We have pleasure in informing you of the results:

At 31 December 2023, pension assets amounted to CHF 673.8 million (31 December 2022: CHF 645.7 million).

The return generated on total assets in 2023 amounted to 7.7% (2022: -8.68%). Investments ended the year with a profit of CHF 47.3 million (2022: loss of CHF -59.1 million).

The funding ratio as of 31 December 2023 increased to an encouraging 113.9% (2022: 106.5%).

With a view to a medium-term planned reduction in the technical interest rate to 1%, a provision for a reduction in the technical interest rate was created and CHF 2 million has been allocated to this provision annually since 31 December 2019. The board of trustees decided in December to reduce the technical interest rate from 1.5% to 1.25% and to release the reserve accordingly. There will be no further reduction in the technical interest rate for the time being due to the current interest rate situation.

The income surplus of CHF 42.6 million was allocated to the fluctuation reserve. This amounts to CHF 81.8 million as of 31 December 2023. The target value of the fluctuation reserve is CHF 101 million.

Number of members

At 31.12.2023 the number of active employees insured under the Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe stood at 1,165 (31.12.2022: 1,139). Breakdown by company:

- Feldschlösschen Getränke AG – 404

- Feldschlösschen Supply Company AG – 651

- Carlsberg Supply Company AG – 107

- Carlsberg Mobility Programme – 3

At 31.12.2023 the number of pensioners drawing benefits amounted to 1,220 (31.12.2022: 1,277).

Further information on the year-end financial statements can be found in the Annual Report, which will be published in May.

Information on the Board of Trustees Meeting held on 8 December 2024

The Board of Trustees has passed the following resolutions:

Interest on retirement savings

Effective 1 January 2024, the Federal Council has decided to increase the BVG minimum interest rate from 1% to 1.25%. The

By law, the minimum rate is fixed on the basis of developments in the return on government bonds as well as the trend in equity markets, loans and real estate. The Federal Commission for Occupational Pension Plans (BVG-Kommission) and the social partners are consulted ahead of the Federal Council’s decision.

In view of the pension fund’s current financial situation, the Board of Trustees has made the following decisions concerning interest on retirement savings:

- In 2023 retirement savings will be subject to an interest rate of 1%. The Board therefore abides by its decision of December 2022.

- In 2024, the minimum interest rate of 1.25% will be applied to retirement savings.

Interim results as at 31 October 2023

In line with market conditions, a negative absolute return of -0.68% was reported in October. Since the beginning of the year, the pension fund portfolio has achieved a positive return of +3.26%.

As of 31.10.2023, the pension fund assets amount to CHF 647.17 million (31.12.2022: CHF 645.75 million).

The funding ratio as at 31.10.2023 is 108.85% and has decreased again slightly compared to the last interim financial statements (30.6.2023: 111.07%). Annual financial statement 31.12.2022: 106.5%.

The fluctuation reserve amounts to CHF 52.18 million as at 31.10.2023 (31.12.2022: CHF 39.18 million). The target amount is CHF 101 million.

Number of members

At 31.10.2023 the number of active employees insured under the Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe stood at 1,164 (31.12.2022: 1,139). Breakdown by company:

- Feldschlösschen Getränke AG – 404

- Feldschlösschen Supply Company AG – 650

- Carlsberg Supply Company AG – 107

- Carlsberg Mobility Programme – 3

At 31.10.2023 the number of pensioners drawing benefits amounted to 1,235 (31.12.2022: 1,277).

Information on data protection

The fully revised Federal Act on Data Protection (nFADP) came into force on 1.9.2023. The nFADP governs the processing of personal data and, like its predecessor, is designed as a framework law governing the protection of personal data in general. Data protection is nothing new for pension funds: pension funds have in the past been obliged to comply with the data protection provisions of the Federal Law on Occupational Old Age, Survivor’s and Disability Pensions (BVG) in the execution of their activities. However, the entry into force of the nFADP entails information obligations towards the beneficiaries. Please take note of the following explanation on data protection:

Data protection in a nutshell

Your Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe, c/o Feldschlösschen Getränke AG, Feldschlösschenstrasse 34, 4310 Rheinfelden, is responsible for processing your personal data. We process personal data either on the basis of the Federal Law on Occupational Old Age, Survivor’s and Disability Pension (BVG) or any other legitimation under data protection law, if such a basis is required.

Within the framework of the legal duty of confidentiality, we treat your data strictly confidentially.

We record personal data from the moment you join the pension fund, process such data further to calculate and collect contributions, and need it to determine and pay out pension benefits.

In order to provide our services, we regularly exchange data with the bodies mentioned in Art. 86a of the BVG and other bodies necessary for the implementation of your occupational pension scheme, to the extent permitted by law. We store all your data in Switzerland.

You can find more information on data protection here.

If you have any questions relating to data protection, please do not hesitate to contact:

Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe

PO Box

CH-4310 Rheinfelden

Switzerland

info@pvs-feldschloesschen.ch

Tel. 058 123 48 44

AHV 2021 Revision – Increase in Women’s Retirement Age

Changes in Occupational Pension Plans

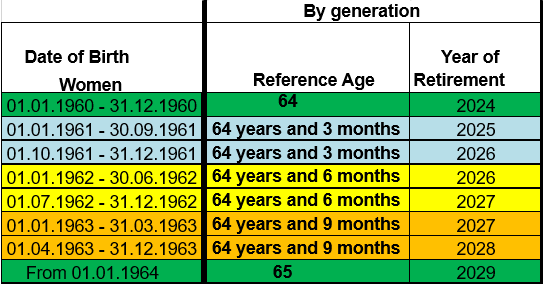

On 25 September 2022, Swiss voters approved the reform to stabilise the AHV. The retirement age of 65 (reference age) for AHV (Old Age and Survivors’ Insurance) and BVG (Occupational Pension Schemes) is to be harmonised at 65 years for men and women. For women born in the transition years of 1961, 1962, 1963 and 1964, the reference age will be gradually increased by 3 months:

Year of birth 1961: Reference age 64 years and 3 months

Year of birth 1962: Reference age 64 years and 6 months

Year of birth 1963: Reference age 64 years and 9 months

Year of birth 1964: Reference age 65

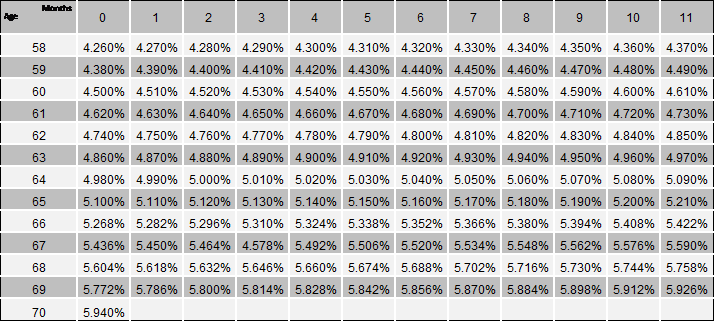

The legal changes in the AHV also result in amendments to occupational pension schemes. The regulations of the Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe provide for different conversion rates for men and women:

Woman (64) = 5.1% Man (64) = 4.98%

Woman (65) = 5.268% Man (65) = 5.1%

The conversion rate of 5.1% for age 65 is now to be applicable for women too.

For this reason, after reviewing various scenarios at its last meetings on 9 May and 15 August 2023, the Board of Trustees has made the following decisions:

Statutory or early retirement up to 31 December 2023

For women (born 1959) who enter retirement between now and 31 December 2023, the conversion rate remains unchanged at 5.1% at age 64. Based on this conversion rate, women taking early retirement between now and 31 December 2023 are subject to correspondingly lower rates. This is unchanged from the current approach.

From 1 January 2024, the reference age of 65 and a conversion rate of 5.1% will apply to all insured members (men and women). This means that the reference age will be directly set at 65 (no gradual increase).

Scale applicable from 1 January 2024:

This change results in lower conversion rates for women. The Board of Trustees has therefore adopted measures in order to guarantee the same level of retirement pension at age 65 to women affected by the transition period and women who have the option of taking early retirement.

Crediting of a one-off premium on 1 January 2024

Women born between 1960 and 1965 will receive a one-off compensatory premium on 1 January 2024.

The affected women will be personally informed about the amount credited in January 2024.

The Board of Trustees is pleased to be able to compensate for this change in the law with a generous solution for those affected.

Additional information and details

Please note that this letter is intended to provide general information.

For concrete questions on your personal pension situation and other questions or requests for additional details, please do not hesitate to contact Susanne Baumberger, Head of Staff Pension Fund, Tel 058 123 44.

Buying into the pension fund: plan in good time

Buy-ins can be made at any time but no later than 8.12.2023, in order to be processed for the 2023 fiscal year.

If permitted by the regulations, pension benefits can be improved by making voluntary contributions (buying in). In principle, buy-ins are tax-deductible. However, the pension plan accepts no liability if the responsible cantonal tax authorities do not permit tax deductions for a voluntary buy-in. If in doubt, we recommend that you check with the responsible tax authority prior to buying in, and obtain a binding statement on whether or not a tax deduction is permissible.

Please note:

- Before buying in for the first time, the form Buying into the pension fund must be completed and submitted to the pension fund.

- If withdrawals have been made to fund the purchase of a home, voluntary contributions may only be paid in once the amounts withdrawn are fully repaid.

- The buy-in amount earns interest (currently 1%) from the date of paying in.

- Please also note that for three years after the buy-in, the resultant benefits cannot be withdrawn from the pension plan in the form of capital (this is particularly important in the case of retirement or if you are planning to withdraw funds in advance for the purpose of purchasing a home).

For questions on the possible buy-in amount or your personal pension plan situation, please do not hesitate to contact Susanne Baumberger, Head of Staff Pension Plan, Tel 058 123 48 44 or Robert Bucher, Tel 058 123 47 54.

Staff Pension Plan Half-Year Results

Improvement as of the end of June

The financial situation of Swiss pension funds has developed positively since the end of 2022. An average performance of 4.6% was achieved in the first half of 2023. The average funding ratio rose to 111.3% as at 30 June 2023.

The Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe achieved a positive return of 4.69% on total assets in the first half of the year.

The funding ratio as at 30.6.2023 is 111.07% and has thus improved again compared to the financial statements as at 31.12.2022 (106.5%).

As at 30 June 2023, pension assets amount to CHF 661.61 million (31.12.2022: CHF 645.75 million).

The fluctuation reserve amounts to CHF 65.66 million as at 30.6.2023 (31.12.2022: CHF 39.18 million). The target amount is CHF 101 million.

Number of members

At 30.6.2023 the number of active employees insured under the Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe stood at 1,155 (31.12.2022: 1,139).

Breakdown by company:

- Feldschlösschen Getränke AG – 400

- Feldschlösschen Supply Company AG – 646

- Carlsberg Supply Company AG – 106

- Carlsberg Mobility Programme – 3

At 30.6.2023 the number of pensioners drawing benefits amounted to 1,261 (31.12.2022: 1,277).

Election of Employee Representatives to the Board of Trustees – Results

The election of employee representatives to the Board of Trustees was duly completed on 24 March 2023. 1,186 voting slips were sent out and 306 votes were cast, corresponding to a turnout of 25.8%.

We therefore have pleasure in announcing the results of the election of employee representatives to the Board of Trustees. The following representatives have been elected:

- “Administration” Unit – Simone Schaub, current representative

- “Customer Supply Chain” Unit – Daniel Berger, current representativ

- “Production” Unit – Marcel Kiesewetter, current representativ

- “Sales” Unit – Ulrich Reinhard, current representative

We congratulate the members on their election and wish them every success and satifaction in their capacity.

We thank the other candidates for their willingness to put themselves forward for election as employee representatives on the Board of Trustees.

Information on the financial statements for the year ending 31 December 2022

Ernst & Young AG has audited the pension fund’s financial statements for the year ending 31 December.

We have pleasure in informing you of the results:

At 31 December 2022, pension assets amounted to CHF 645.7 million (31 December 2021: CHF 746.1 million).

The return generated on total assets in 2022 amounted to -8.68% (2021: +5.02%). Investments ended the year with a loss of CHF -59.1 million (2021: profit of CHF +37.8 million).

Despite the negative investment performance, the funding ratio at 31.12.2022 remained satisfactory at 106.5% (31.12.2021: 116.32%). Many pension funds reported a shortfall in funding on 31.12.2022.

The technical interest rate will be kept at 1.5% for the time being. A provision amounting to CHF 2 million per year is set aside with a view to any future reduction. This reserve was increased by a further CHF 2 million and amounted to CHF 8 million at 31.12.2022.

The loss of CHF 65 million is charged to the fluctuation reserve, which stood at 31.12.2022 at CHF 39.18 million. The target fluctuation reserve is CHF 103 million.

Number of members

At 31.12.2022 the number of active employees insured under the Personalvorsorgestiftung der Feldschlösschen-Getränkegruppe stood at 1,139 (31.12.2021: 1,088). Breakdown by company:

- Feldschlösschen Getränke AG – 394

- Feldschlösschen Supply Company AG – 647

- Carlsberg Supply Company AG – 95

- Carlsberg Mobility Programme – 3

At 31.12.2022 the number of pensioners drawing benefits amounted to 1,277 (31.12.2021: 1,319).

Further information on the year-end financial statements can be found in the Annual Report, which will be published in May.

You will find older articles in the archives.